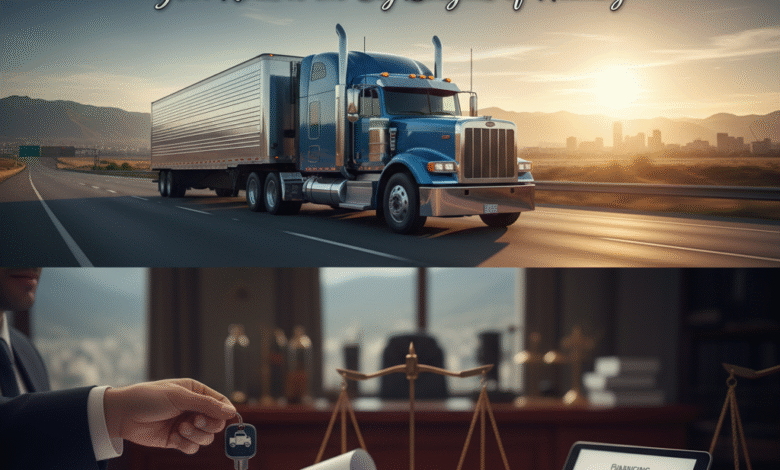

Heavy Truck Loans Your Road to the Big Leagues of Hauling

Heavy Truck Loans Your Road to the Big Leagues of Hauling

Heavy Truck Loans Your Road to the Big Leagues of Hauling

Because sometimes your dreams are 18 wheels wide.

If you’ve ever stood on the side of a highway, eyes locked on a roaring Peterbilt or Kenworth, and thought “That could be me,” you’re already halfway to the world of heavy truck loans. we’re not just here to tell you what’s new — we’re here to make sure your wheels keep turning.

Why Heavy Truck Loans Matter More Than You Think

Heavy trucks aren’t toys. They’re rolling businesses, and without them, the entire economy grinds to a halt. A loan for one of these beasts isn’t just “buying a vehicle” — it’s:

Securing an income stream

Building your logistics empire

Investing in a long-term asset

“A truck loan isn’t debt — it’s a ticket to the open road and a shot at financial independence.”

— Strel.xyz Financing Insights Team

What Exactly Is a Heavy Truck Loan?

Think of it like a mortgage… but for your office on wheels. Whether it’s a Freightliner Cascadia for long-haul runs or a Mack Granite for construction hauling, these loans are designed with:

Specialized repayment terms (longer than your standard car loan)

Higher principal amounts (trucks aren’t cheap)

Collateral-backed security (your truck is the collateral)

Types of Heavy Truck Loans You Should Know

Here’s the quick breakdown — because not all truck financing is created equal:

Commercial Truck Loans — For licensed businesses hauling goods or materials.

Owner-Operator Financing — For solo drivers starting their own freight business.

Leasing-to-Own — Lower upfront costs, gradual ownership.

Refinancing Options — If you already have a truck and want better rates.

Tips Before You Sign That Loan Agreement

Before you hit the “Apply” button, keep these in mind:

Know your credit score – It will affect your interest rate.

Calculate your ROI – Can the truck earn more than the loan costs?

Shop lenders like you shop for trucks – Never take the first offer.

Read the fine print – Early repayment penalties can hurt.

Heavy truck loans are more than numbers and signatures — they’re the bridge between your ambition and the open road. Whether you’re hauling coast-to-coast or building a regional fleet, the right financing can turn a dream into a profitable reality.